There are many good reasons why financial experts recommend building an emergency savings fund. Having a dependable reserve of money can allow anyone to handle unplanned expenses without relying on credit cards or loans. And for some, emergency savings can even make a difference between leaving a toxic job or relationship — or getting stuck in a bad situation for months, years, or even decades.

In this post, we’ll talk about how emergency savings can contribute to financial well-being and cover tips for how to grow your emergency savings account.

What Constitutes an Emergency?

Most people have heard the term “emergency savings.” But what exactly counts as a true “emergency”?

An emergency is anything you didn’t expect to happen this year. Here are some examples.

- Job loss

- Car accident

- Medical diagnosis

- Major home repair (like a flooded basement or a leaking roof)

Notice that these examples are different from situations that you already know can or will happen. Buying Christmas presents, back-to-school shopping for the kids, or a summer family vacation are not on the list of emergencies. These expenses can be anticipated and planned for in advance.

If you have trouble budgeting for these types of purchases, we recommend opening a separate savings account earmarked for those expenses. With small yet regular contributions during the year, you can feel more prepared.

Emergency Funds Are Good Cash Flow Management

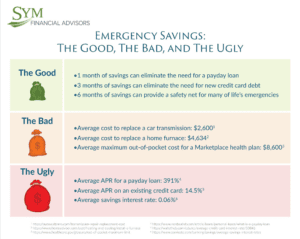

A healthy emergency savings account can go a long way toward helping you handle an unexpected car repair or a large medical bill. But having a properly sized emergency fund can do even more.

For many people (and especially for women), money or lack thereof can make them feel trapped. They might feel forced to stay in an unhealthy marriage or to maintain dysfunctional relationships just because they don’t have anywhere else to turn financially.

Having enough emergency savings could be the financial cushion that you need to finally make important changes in your own life.

- Leave a job that makes you feel miserable and find a new opportunity where you may feel valued, appreciated, and challenged.

- Feel financially secure enough to contribute consistently to tax-advantaged retirement accounts like a 401(k) or IRA.

- Have the means to get yourself and your family out of a bad or even dangerous situation.

Emergency funds can also help you boost your chances for long-term financial success. When faced with a large expense, it is not unusual to see people dip into retirement savings or sell some investments. Both of these scenarios can be a problem, especially if the markets are temporarily down.

A better approach would be to build up your emergency fund. That way, you won’t be backed into a corner and feel like you have to sell your investments at a loss just to cover the bills. Your day-to-day finances and your retirement portfolio can exist independently of one another, and whatever happens in the markets today won’t have a dramatic impact on your overall financial plan.

How Much Emergency Savings Should I Have?

Wouldn’t it be great if you had tens of thousands of dollars ready to handle any crisis that comes your way?

While building up a robust safety net is a smart thing to do, having too high a target is not realistic for most people. And even if you did achieve that astronomical goal, an unnecessarily large balance in emergency savings can potentially take away from your overall financial well-being.

When you have too much money in cash, you can miss an opportunity for portfolio growth. On top of that, since interest rates are so low, the purchasing power of cash is potentially subject to inflation.

Most financial experts recommend an emergency savings goal of at least 3 to 6 months’ worth of living expenses (1). It’s important to note that they are talking about living expenses — not income. The idea is that if you ever lost your job, you would want to use these funds to cover your bills until you can get back on your feet again.

Keep in mind that this recommendation is just a starting point. For some people, 3 to 6 months’ worth of living expenses may not be enough. Depending on your financial situation and goals, you may need to adjust your target. Here are some examples.

- If you work in a high-risk job or industry (such as travel and hospitality)

- If you have an unsteady income (such as someone who works independently or as a freelancer)

- If you hope to change careers, start your own business, or try something new in the near future

In short, the right answer will depend on you. We recommend taking the Goldilocks approach. Don’t try to save up too much, and don’t stop with too little. Determine an amount that’s somewhere in the middle and just right.

How to Setup an Emergency Savings Fund

Setting up an emergency fund is simple to do. Here’s how to get started.

1. Open an Account

First, open a savings account that is separate from your day-to-day expenses but still accessible. It could be at your same bank or a different one. This new account will serve as your dedicated emergency savings fund.

2. Set Up Transfers

Next, request to make regular transfers from your primary bank account to the emergency fund. Most accounts have a feature where this can be done automatically. You might decide to schedule the transfer once per month or align it with your personal paycheck frequency (i.e., every two weeks).

3. Build Up Your Account

Regular transfers are great. If you are looking to supercharge your emergency savings routine, consider adding these ideas.

- Allocate windfalls. Every time you get an income tax refund, profit-sharing check, or a raise from work, put it in your emergency fund.

- Adjust your paycheck. If you usually get a big income tax refund and struggle to find enough money to save each month, then perhaps the tax withholdings for your paycheck need adjusting. Ask your workplace HR for a new W-4 form and see if any changes are necessary.

- Cut back on expenses. Look for unnecessary expenses, like unused subscriptions and other “lost money” in the family budget. Re-channel those savings back into your emergency fund.

- Make more money. Ask for a raise or consider taking up a side hustle so that you can add more funds.

The more you make your emergency savings a priority, the faster it will grow and the more financially secure you’ll become.

Are you or someone you love looking for more ideas on how to manage the financial puzzles of life as a woman who is navigating the complexities of planning for both children and parents? Then join SYM financial advisor Michelle Hipskind and attorney Lindsay Kohler for an in-depth conversation that shines a light on these important issues. This in-person event is happening on March 10, 2022 at 5:30 PM. To learn more and to RSVP, please follow this link. There is no charge to attend but space is limited. Reserve your seat today.

(1) https://investor.vanguard.com/emergency-fund/amount

Disclosure: The opinions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. SYM reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness. SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.