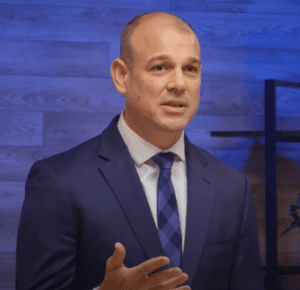

We recently asked SYM’s Chief Investment Officer Andy Popenfoose this question. This is a paraphrase of what he shared. Catch his exact words in the video above.

AI is a major force in the economy.

AI is a major force in the economy. I have been following the developments of artificial intelligence for a long time. What we have witnessed in the last few quarters is that AI is not only a scientific field, but also a practical tool that anyone can use for fun or for work. This creates a lot of optimism and opportunities in the economy, and I think that is justified.

AI doesn’t necessarily impact your investment portfolio the way you may think.

Investing based on that premise of AI being a major force presently is a different story. It is a common fallacy to assume that the most promising sector of the economy will translate into the highest returns for investors. That is often not the case, or even the opposite, because the most optimistic areas tend to have the most overvalued stocks. Those stocks have to deliver extraordinary profits to justify their high prices. In 2023, the main drivers of the market rally have been the stocks that are most directly related to or benefit from AI. That is not surprising, but it does not mean that they will continue to outperform in the future. There are many challenges and uncertainties in the AI space. There could be new competitors that we don’t know about yet, especially in the tech industry where innovation is fast. There could be difficulties in monetizing AI applications, as we have seen with some of the existing tech giants who took years to make their products profitable.

The bottom line.

So, while I am very optimistic about AI as a positive force for society and for everyday life, I would not bet all my money on it as an investment strategy.

Disclosure:

The opinions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice.

This material is not financial advice or an offer to sell any product. SYM reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs and there is no guarantee that their assessment of investments will be accurate. This material contains projections, forecasts, estimates, beliefs and similar information (“forward looking information”). Forward looking information is subject to inherent uncertainties and qualifications and is based on numerous assumptions, in each case whether or not identified herein.

SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees and objectives can be found in our ADV Part 2, which is available upon request.

Chartered Financial Analyst® (CFA®) are licensed by the CFA® Institute to use the CFA® mark. CFA® certification requirements: Hold a bachelor’s degree from an accredited institution or have equivalent education or work experience, successful completion of all three exam levels of the CFA® Program, have 48 months of acceptable professional work experience in the investment decision-making process, fulfill society requirements, which vary by society. Unless you are upgrading from affiliate membership, all societies require two sponsor statements as part of each application; these are submitted online by your sponsors.