Corporate executive compensation packages often include stock options. As a supplement to a base salary, these options can be a powerful wealth creator and a core component of your overall investment portfolio and retirement plan. We believe executives need to keep in mind that the volatility and tax intricacies of these options require deft hands to manage. Wrong choices can have lasting impact and easily overpower your overall risk profile.

Quick Primer on Stock Options vs Restricted Stock

While executive compensation packages have increasingly included restricted stock units (RSUs) in recent years, stock options are still prevalent among established, publicly traded companies. The goal of both is the same from the company’s perspective — to attract and retain top talent by allowing an individual to participate in the future upside of the company. The past couple of years have seen an increase on both as nearly half of companies reported higher attrition[1] rates in 2021 versus prior years.

While RSUs have the advantage of technically never being “underwater” (held at a loss), they create immediate tax consequences once they become vested, even if you don’t sell the shares since they are recognized as earned income.

Stock options, meanwhile, have an awarded price or strike price, ideally one that is well below the current market price of the stock once the options vest. You, like many executives, may find yourself with different lots (groupings) of stock options at different exercise prices and different vesting timelines. Either some or all of a specific lot of stock options can be exercised once the options have vested.

Both restricted shares and stock options do a good job of aligning the company’s incentives with your own. By giving you “skin in the game,” you are more directly impacted by your company’s long-term success. Recent trends have seen equity compensation plans evolve to better cater to employees’ wants. Morgan Stanley surveyed companies about what changes they are making to equity compensation programs, and nearly one-third of respondents reported they have shortened vesting schedules and made plans otherwise more flexible. [2]

When it comes to integrating stock options into your total financial and retirement picture, there are several proactive steps to take and some common pitfalls to avoid. Here are three keys to extracting the most from your stock options package:

#1 – Create a Methodical Plan — and Stick to it

The most senior executives of a corporation have a regimented schedule for their options packages, and they don’t deviate from it. Look to copy what they do — create a battle plan that involves automated exercising, stock sales, and annual tax monitoring. This not only removes the burden of constantly making decisions on the fly, but it sidesteps a pitfall that many executives unfortunately make — leaning on a bias of the future of the company.

With any investment, bias is an enemy to avoid. Bias is about having a blind spot somewhere — a slightly irrational confidence that overrides prudent money management principles. And one of the most common types of bias comes in the form of, “My company is fantastic and will consistently succeed.”

It’s great to have a strong faith in your company’s prospects. And as an executive, you have a unique vantage point on how the company is performing compared to its competitors and peers.

But when dealing with stock options — and eventually, shares of stock itself — you must keep in mind that your opinion is not what is going to move the stock price.

The price of the stock in the open market is going to fluctuate based on how millions of other people view the company. They may be shortsighted, prone to bouts of fear and greed, or otherwise irrational — in any case, their behavior is something you’ll never be able to predict. Even if your company succeeds on all fronts, the stock price could still fall if the broad economy or stock market falters.

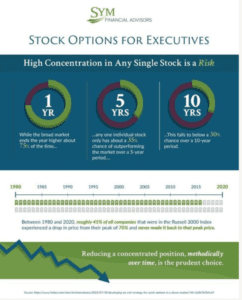

Having a methodical and disciplined plan for stock sales and exercising options can also keep you in front of income tax planning objectives and most of all eliminates your exposure to a highly concentrated position.

#2 – De-Risk Throughout the Rest of Your Portfolio

It’s a delicate dance to give your stock options and shares “room to run” without exposing your net worth to massive volatility swings. Stock options can quickly become a lion’s share of your investment portfolio, but what seems like a blessing is also very risky.

It’s rarely, if ever, worth exposing yourself to the whims of the stock market with such a large component of your nest egg — no matter how much you love and believe in your company.

De-risking your portfolio can be done in several ways. Reducing overall single stock exposure through outside investments is key. We think a good rule of thumb is to diversify your company stock exposure whenever possible knowing you will have the future upside opportunity as you receive company stock awards in the years to come.

Reducing single sector exposure can be just as important. SYM recommends broad diversification of any sector. If investment sentiment sours in a particular industry, other industries represented in your portfolio can potentially balance out the dip during that period where the sector may not be performing well. A diversified portfolio that contains a balance of many differing sectors is designed to tolerate market movement and minimize volatile outcomes.

#3 – Delegate to Experienced Pros

If you haven’t already, you’ll soon see that the personal financial decisions you face as an executive are extremely complex.

The tax side of managing your equity compensation is tricky — analyzing differences in qualified and non-qualified options (NSOs), RSUs, and stock options would be overwhelming enough if things remained static. But, each year your tax picture will be slightly different. An experienced hand to guide you toward optimizing your equity compensation while attaining favorable tax treatment is paramount.

Sure, you could tackle all of these choices with the same bravado you use to run your company, but chances are, stock options aren’t your area of expertise. Our team can guide you by sharing the invaluable insights, lessons, and knowledge we have gained from working with countless other executives in a wide variety of companies over many decades.

SYM Financial is a fiduciary and Registered Investment Advisor who specialize specifically in stock option management, planning, and strategy. We can help you analyze market dynamics and apply rigorously tested, academic methods to customize a strategy for your unique needs and make the most of your concentrated stock position. Reach out to a team member at SYM Financial today to harness the full power of your equity compensation while staying true to your long-term planning goals.

The opinions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. SYM reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

This blog is for informational purposes only and does not constitute investment, legal or tax advice and should not be used as a substitute for the advice of a professional legal or tax advisor.

Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness.

SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.

[1] https://www.shrm.org/resourcesandtools/hr-topics/compensation/pages/companies-ramp-up-stock-compensation-to-compete-for-talent.aspx

[2] https://www.morganstanley.com/atwork/articles/state-of-equity-plan-management-report-2022

Disclosure: The opinions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. SYM reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This blog is for informational purposes only and does not constitute investment, legal or tax advice and should not be used as a substitute for the advice of a professional legal or tax advisor. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness. SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.