Newer companies often get hit with a whirlwind of administrative and legal tasks, many of which are met with sighs and eye rolls when someone suggests they need to be tackled. Entrepreneurs may be very good at vision and managing daily operations but can neglect to take care of non-glamourous aspects of setting up a well-protected business. Every company, even a younger one, should have a plan if something sudden and unforeseen occurs that can allow them to continue operating without undue financial burdens or liabilities.

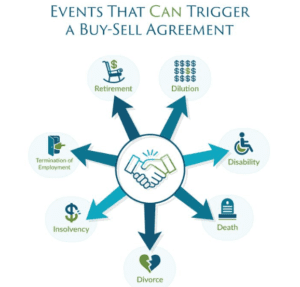

A buy-sell agreement is a key document to have for the protection of the owners. This paperwork legally establishes path(s) for planned transfer of ownership, like a sale, or for unplanned, such as the death or disablement of the owner, or even if the business fails and bankruptcy occurs. Here are some of the most common questions that business owners have about setting up buy-sell agreements, along with some best practices for creating and maintaining them.

Do early-stage startup founders need a buy-sell agreement?

Yes, creating a buy-sell agreement in the early stages of company formation is a prudent choice. As with wills and life insurance, it can be uncomfortable to think through scenarios that involve the worst-case scenario, but having the discussion is best for the business itself and for all the partners involved.

Imagine a scenario where a founder dies suddenly or becomes incapacitated. With no buy-sell agreement in place, ownership and decision-making powers could be stuck in a court battle and effectively freeze the company. Even something like a divorce could lead to ownership shares being split between two people, one of which has no vested interest in the company.

Risks like these are easy to mitigate with basic buy-sell agreement components like clauses for death, the valuation of each founder’s share, and who gets the first right to buy out someone’s share in the event they leave the company for any reason.

What happens if a sale agreement expires?

A well-structured buy-sell agreement will have provisions to address how revisions can be made, and by whom. If an agreement expires without a rollover provision, then a new buy-sell will need to be drafted and signed.

If a buy-sell agreement expires and none of the key people/owners have changed, then it’s a good time to renegotiate the terms of the agreement, taking into account new information, business structures, valuations, and the amount of insurance needed to account for buyout provisions.

Is it possible to cancel a sale agreement?

If any of the legal provisions established in the agreement are violated, then a buy-sell agreement can be nullified, yes. It will likely require legal support to prove that the buy-sell is no longer valid because of a violation of terms or one of the owners acting in bad faith. A well-structured agreement includes language that itself will account for what is considered a nullifying event.

Does the seller or buyer pay for a business valuation?

For an early-stage company, the initial business valuation will generally need to be agreed upon by the founders/owners. This initial valuation may or may not be determined with the help of outside counsel. The initial valuation is important because it will set the terms and price for how much each owner’s share is worth, and how much life insurance will be required for each key person in the event they need to sell their share or buy out another owner’s share.

A common feature of a buy-sell agreement valuation is a formula to steadily increase the valuation of the business each year in an effort to reflect the anticipated growth of the company. This valuation increase is typically based on a multiple of book value, earnings, or gross revenue.

If a “triggering event” in the buy-sell occurs, resulting in an owner selling off their interest, a potential buyer will want to conduct their own due diligence on the company’s valuation, which could lead to a negotiation process with the remaining owners.

What is a shotgun clause?

This is a common clause found in buy-sell agreements, and it is tied to the various “triggering events” that necessitate a transfer of shares from one owner to another owner, or to an outside third party. A shotgun clause aims to speed up the time to make a transfer of ownership. Played out, the interested buyer would make a specific valuation offer for another’s shares, and the selling party must either accept the offer or make a specific counteroffer.

A shotgun clause allows for a real-time assessment of the valuation of the business, should the valuation laid out in the agreement prove to be stale or irreflective of current market conditions.

Do I need any type of insurance to protect my buy-sell agreement?

The vast majority of buy-sell agreements are created with specific insurance policies put in place for each owner. Life insurance policies and/or disability insurance covering each owner is purchased in the company’s name, with death benefits in an amount that is designed to approximate each owner’s share in the business.

In the event of an owner’s death, the beneficiary (the company) uses the proceeds to buy out the deceased owner’s share(s). Buy-sell agreements structured in this way are known as “redemption agreements.” Another type of buy-sell structure would incorporate a “cross-purchase agreement,” whereby each owner purchases a life insurance policy of every other owner, so that in the event the policy pays out, the other owner(s) use the proceeds to purchase the deceased’s shares or ownership interest.

What is the difference between pricing and valuation?

When it comes to buying an interest in a business, the valuation is a theoretical value, whereas pricing is the real-world, real-time amount that someone will pay for it. Valuations are a good placeholder when a young business is creating key legal documents like buy-sell agreements, but pricing is when the proverbial rubber meets the road.

In the event that an owner seeks to sell their ownership stake, the pricing offer could differ dramatically from the valuation set forth in the original buy-sell agreement. Companies that are growing fast will want to make, at minimum, an annual adjustment of the company’s valuation so that the valuation and potential pricing values are as close as they can be. This allows for more efficient purchasing of insurance policies and helps to expedite any ownership share change should one occur — or be forced into action.

How are retained earnings factored into a business valuation?

Retained earnings are company earnings left over after all income sheet expenses have been paid — this includes employee compensation, accounts payable, taxes, dividends, and cost of goods sold. Retained earnings is a cumulative measure over the lifetime of the company, and as such they yield little insight into the actual valuation of a business. It’s what a company does with those retained earnings — how effectively they are reinvested into the business — that speaks more to the valuation of the company.

Retained earnings can be set aside as a “sink fund” with the established purpose of buying out an owner’s share in a buy-sell agreement but tying up corporate cash this way is an inefficient way to secure the funds to buy out another owner’s interests.

What are key components, considerations, or tips for a buy-sell agreement?

No two buy-sell agreements will look exactly the same, but there are some particulars that find their way into almost every agreement:

- Naming all owners and their percentage ownership interest

- Naming any key employees who do not have ownership interest

- Outlining a continuity plan in the event of an owner’s departure, death, disability, or divorce

- Determining the beneficiaries of any life insurance policies — and how the transfer of ownership will affect the remaining owner(s)

- Creating non-compete clauses or separate agreements should an owner leave the company

- Laying out how disputes between owners will be settled (arbitration, mediation, etc.)

- Outlining tax implications of any triggering event or transfer of ownership

- Determining whether each triggering event will cause a mandatory cascade of steps, or an optional one that the owners can choose

Creating a buy-sell agreement may seem like just another administrative “business chore,” but it’s a great opportunity for the founders and owners to sit down and talk through both near-term and long-term goals, both for themselves and the company. If you’re looking for help establishing priorities to draw up your own buy-sell agreement, SYM can help. Start here now.

Disclosure: The opinions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. SYM reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This blog is for informational purposes only and does not constitute investment, legal or tax advice and should not be used as a substitute for the advice of a professional legal or tax advisor. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness. SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.