A deliberate and thoughtful stock options strategy can maximize your wealth by harnessing the power of a significant part of your compensation. Without the guidance of an experienced financial advisor, well-intentioned company stock option recipients are often left on their own to set options targets (triggers for exercising an option). We find that “do-it-yourself” targets are frequently based on one of the following approaches:

- Participate in water cooler talk about how stock prices will fluctuate during the year, then exercise at that price target

- Exercise options as soon as they vest

- Set a target to exercise at x% above the strike price and wait for that price

- Hold on until the options are about to expire in an attempt to avoid the regret of exercising too early

SYM’s Approach to Stock Options Strategy

- Develop a true understanding of how much of your wealth may reasonably remain at risk with options

- Analyze the stock and option characteristics to form price targets based on SYM’s proprietary, time-tested research

- Recommend a customized strategy for exercising or holding options to seek future upside

- Implement and execute the plan with rigor and discipline to ensure action is taken

Maximizing Your Financial Capital

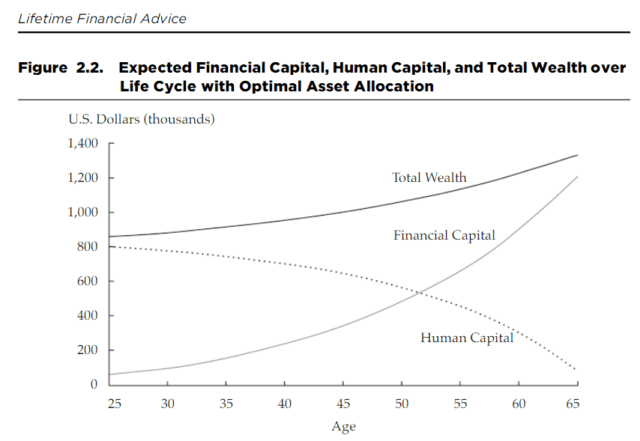

There comes a point in life when your money should be working harder than you do. Let the SYM team guide you through a wide-angle approach to your equity compensation.

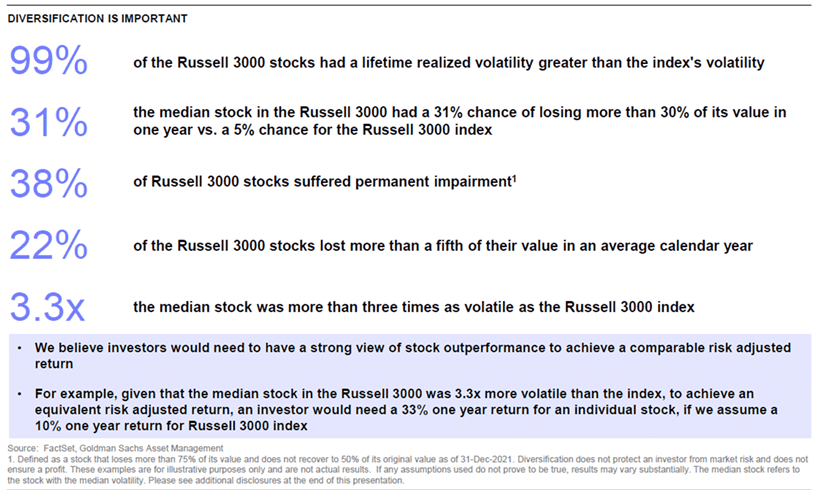

Diversification

Diversification is critical, and de-risking a highly concentrated position in the stock of your employer requires care and attention. Without a thoughtful plan for diversification, single stock risk can sidetrack or diminish an individual’s overall net worth trajectory.

Risk vs. Reward

At SYM, wealth management isn’t “one size fits all.” When establishing exercise targets, your SYM advisory team creates a customized approach that takes into account your risk profile, the impact on your total net worth, the aggressiveness of your overall portfolio, and the economic significance of the payoff at-risk. Want to learn more? Connect with a SYM advisor at www.sym.com.