“There were so many big events competing for our attention this last year …,” said nearly every investor, almost every year, ever.

We’re not making light of last year’s uncertainties. Inflation is real and lingering; we can’t rule out the possibility we’ll still see a recession instead of the hoped-for soft landing (although neither has been reported yet). Heightened levels of market volatility across stock and bond markets alike may have left you once again wondering whether this time is different. Wider worries prey on our minds as well, including the war in Ukraine; totalitarian aggression in other hot spots around the world; ongoing discord closer to home; and oh yes, lingering variants of the global pandemic.

The Implications of Recency Bias

But it’s also important to remember, we’re inherently biased to pay more attention to recent alarms than long-ago news. In the right context, this form of recency bias makes perfect sense. As we go about our lives, it’s often best to prioritize our most immediate concerns—or else. No wonder we’ve gotten so good at it.

However, as an investor, if you overemphasize the news that looms the largest, you’re far more likely to damage your investments than do them any favors. Today’s 24-hour news cycle and constant barrage of electronic messaging simply pours gasoline on that fire. You’ll end up chasing hot trends, only to watch them combust or fizzle away. Or you’ll jump out during the downturns, without knowing when to jump back in.

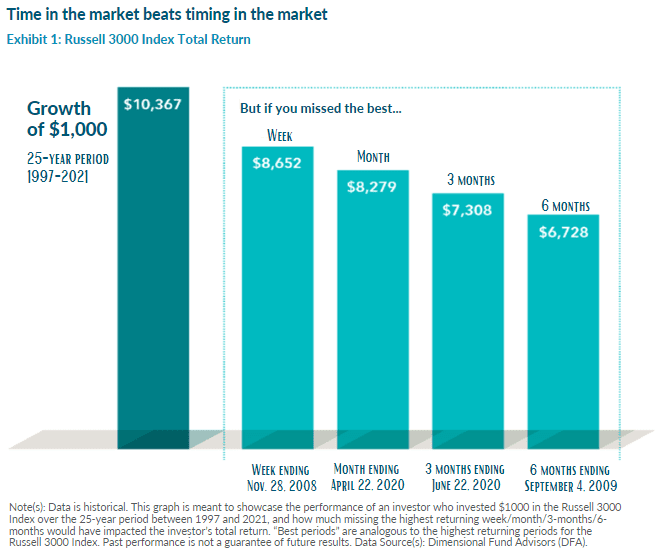

As an example, let’s look at a $1,000 investment into the Russell 3000 in 1997. Let’s say you stayed in the market during the tech bubble, 911, the Great Fiscal Crisis and a global pandemic. After 25 years, your investment would have grown to $10,367. However, if you succumbed to the headlines and jumped out of the market, your return would have eroded. If you had missed just three months in the spring of 2020, your account value would be just $7,308. Missing just three months of recovery out of an entire 25-year period would have cost you more than $3,000. That’s because once you are out of the market there is no way to know when to get back in!

Yesterday’s News

How do we defend against recency bias? It can help to place current events in historical context. Do you remember what investors were worrying about a year, several years, or several decades ago? If you experienced some or all of these events first-hand, you might recall how you felt at the time, before we had today’s hindsight to inform our next steps:

- 2021: The Taliban takes control in Afghanistan, while a “ragtag army” of online traders led by Roaring Kitty storms Wall Street.

- 2020: COVID-19 shuts down economies worldwide. Civil unrest rides high across a gamut of socioeconomic concerns, and a divisive U.S. presidential election looms large.

- 2018: Two S. government shutdowns occur—in January and again at year-end, with the latter lasting more than a month.

- 2016: The Brexit referendum and U.S. presidential election deliver surprising outcomes.

- 2013: A 16-day S. government shut-down occurs in the fall.

- 2011: For the first time, the U.S. federal government credit rating is downgraded by one of the major rating agencies from AAA to AA+, and the Occupy Wallstreet movement is born.

- 2007: The Great Recession and global financial crisis

- 2001: The 9/11 terrorist attacks send global markets reeling. An accounting scandal at Enron culminates in the energy giant’s bankruptcy.

- 1999: The dot-com bubble bursts; the Y2K bug spurs massive, worldwide computer reprogramming.

- 1990: Iraq invades Kuwait.

- 1980:S. inflation peaks at 14.8%; Americans are marching in the streets over the price of groceries. Also, the U.S. Savings and Loan crisis begins, ultimately costing taxpayers an estimated $124 billion.

- 1973: An OPEC oil embargo “fueled bedlam in America.”

These are just a few examples. They don’t include the market’s endless stream of lesser alarms that are easy to dismiss in hindsight, but they repeatedly generated as much real-time storm and fury as the more memorable events.

The point is there’s always something going on. Each time, we think “but this time it’s different.” And even as global markets persist, we forget or rewrite our memories, until they’re no longer available to inform our current resolve. Certified Financial Planners™ understand these biases. It is their job to know historical trends and reconcile the scary headlines with time-tested strategies. Lean on them to add objectivity and coach you through uncertainty. They are credentialed in the key fundamentals and can help to protect you (and your financial plan) from yourself.

Investment Mainstays

In the face of today’s challenges and tomorrow’s unknowns, we advise looking past current headlines and recent trends, and focusing instead on a handful of investment fundamentals that have stood the test of time. They may seem unremarkable compared to the breaking news. But more often than not, it’s the fundamentals of the design that keep a house upright, not the lack of storms. And when has “buy low, sell high,” or “a penny saved is a penny earned” become a bad idea once all the excitement is over?

Next up, we’ll review some of these investment fundamentals, and how they apply to you and your personal wealth. Until then, feel free to contact us for guidance.

Disclosure: The opinions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. SYM reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This blog is for informational purposes only and does not constitute investment, legal or tax advice and should not be used as a substitute for the advice of a professional legal or tax advisor. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness. SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.