While the compensation structure of a corporate executive is definitely one of the perks of rising in the ranks, the vast complexities of the modern executive compensation package also leave the door open for missteps around every corner.

Many freshly minted executives want to keep managing their personal income, retirement, and tax preparation, because that’s the way they’ve been doing it for years. But tap a longtime executive on the shoulder for a piece of advice, and they’ll likely blurt out, “Delegate, delegate, delegate!”

These execs have learned that the more moving pieces your compensation structure has, the more time it takes to simply touch all your bases, let alone immerse yourself in all the key details, dates, and choices that you face. Your time as an executive is perhaps your biggest asset; chances are you have learned the art of delegation when it comes to your business. Now it’s time to make sure you carry those lessons into your personal finances. Your pay package has increased to be commensurate with your increased responsibilities at work; it’s a logical time then to delegate the management of these assets to someone who can help you prevent making any costly errors.

You may ask why, though. How complicated could it really be? The short answer is “very,” but we know you will want more details. Read on for more.

A fiduciary strategist quarterbacking your compensation package can offer tax reduction, financial planning, and wealth management strategies designed to solve the complexity you’ll face in your prime earning years as an executive. Their advice can help minimize your annual tax impacts in the short term, but also help you position your assets and direct your cash flows into the most efficient accounts and “vehicles” that serve your retirement and wealth planning goals long into the future.

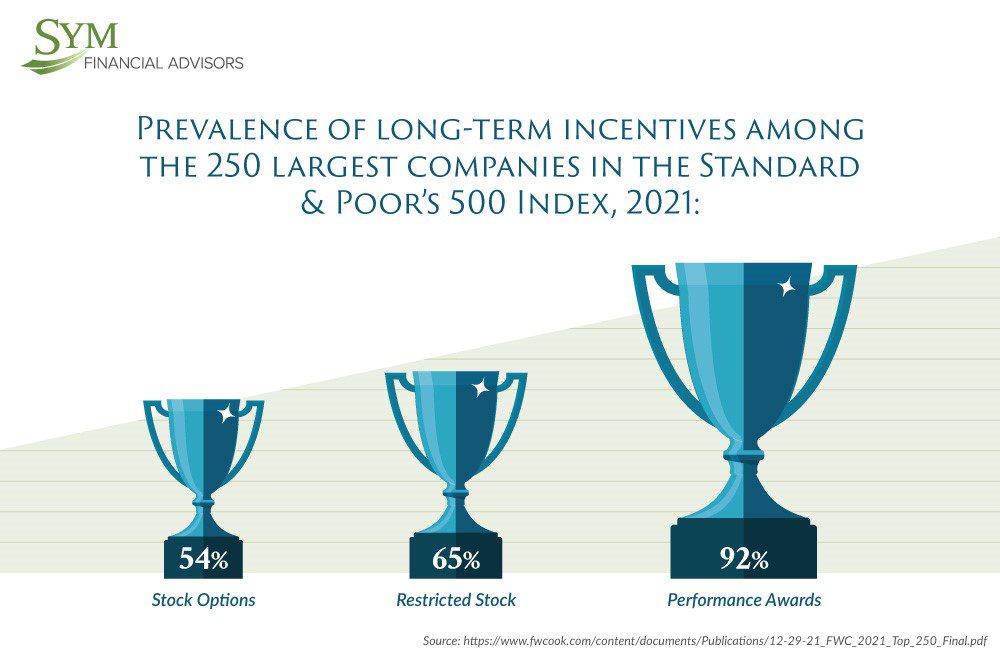

Common Executive Compensation Variables

Let’s take a look at some of the common features of an executive comp package and highlight the areas that often have payouts, deadlines, and expirations attached to them.

- Restricted Stock

- Annual Bonus

- Performance Awards

- Stock Options and Stock Appreciation Rights (SARs) — expiration, vesting

- Employee Stock Purchase Plan

- Deferred Compensation Plans

- Liquidity Events (IPO, M&A)

Each of these compensation elements have dates, rules, and regulations that can change at irregular times.

Restricted stock awards create an initial tax event as it is received as taxable compensation. A concentrated stock position should be looked at through the diversification lens of one’s entire portfolio as many times the grants are received as shares. Stock awards typically have a standard “statutory” federal withholding tax applied by the company of 22%, which is likely to be too low and requires more advanced tax planning which may result in consulting an advisor who can guide you further regarding the tax obligation.

Annual bonuses and other compensation incentives can cause a shift in tax bracket. This variability in total compensation may create the need for strategy discussions with a financial planner to consider income and any tax mitigation strategies to deploy for the year. A relatively simple planning decision like moving to a state with a lower income tax rate can have massive effects on a retirement plan.

Stock options/SAR programs have critical dates for vesting and expiration, and each grant or award creates a unique financial planning element, such as when to convert to shares versus a full or partial liquidation of the options to cash.

Multiple years of options awards means multiple sets of varied and important dates on the financial calendar. It’s not at all uncommon for financial advisors to be managing several separate compensation variables for C-suite executives.

The best financial advisory service will seamlessly integrate these variables to a long-term retirement plan and wealth preservation strategy. They will proactively work with their executive clients, anticipating future compensation dates, events, and strategies. This in turn frees up immense time and focus for the executive to drive company performance and hit the breakpoints on those key business metrics.

Keep in mind, too, that while your personal net worth will inexorably become tied to the success of your company in peak earnings years, this also increases some risks. Many of these risks can be mitigated with a methodical and cohesive financial plan. There’s a 40-50% chance that a portfolio consisting of a single stock will fall at least 25% in any five-year period. Those odds drop to 13% with a diversified portfolio.[1]

Employee stock purchase plans may come with perks like a 15% discount to market price, but only at certain times on the calendar. Prudent advice is needed not only from the tax side, but the investment side. Is it the best use of after-tax money to participate in the program now? Does my retirement plan account for this influx of a single stock?

Deferred compensation is one of highest-leverage spots for any executive from a retirement planning perspective. Best practice around deferred comp generally hovers around holding back on receiving more income during peak earning years, ideally until retirement or in the years following, to see that income arrive at a lower tax rate for the individual.

Executives may see a merger or acquisition at the company where they work, and these can have large tax and financial planning implications. Your financial advisor can help you thoughtfully consider all the paths you can take surrounding these events, as they may have a disproportionate impact on net worth going forward.

An All-Too-Common Scenario

Corporate executives — especially in the first few years of a new promotion or assignment — often find their calendars being bent, twisted — or downright shredded — with activity. Things get hectic, and a subtle deadline on a stock option or enrollment in an executive benefit plan gets missed.

Now not only has money or benefits been left on the table, but a wave of frustration and disappointment crashes over the executive’s mind at the missed opportunities. Later that year, a restricted stock award is granted as part of a bonus, and the busy executive doesn’t notice that the tax withheld is far too low and neglects to set aside cash for the extra tax hit. They glide into the end of the year and start making their typical purchases and gifts, only to realize they’re “cash poor” come January and are forced to sell some investments to square away their tax bill.

Even if you were compelled to read through all the details of every minor change to your entire benefits package, you’re still in a pickle, because you’re still left to wonder how these changes can impact your broad retirement and financial goals.

Parting Thoughts

For every change or shift happening to your benefits package year to year, there’s even more happening on the tax, estate, investment, legal, and regulatory side each year as well. At SYM Financial Advisors, we have an entire practice devoted to the unique planning and strategy needs of the busy executive. We’ve been working with executive clients for decades to maximize the strengths — and minimize the risks and taxes — that come with the modern executive compensation package.

During that time, we have developed razor-sharp optimization techniques to manage intricate compensation calendars, while being there as a thought partner to integrate long-term goals with near-term income strategies. Reach out to a team member at SYM financial today and open a dialogue with us!

Alternative Quote: Having a fiduciary strategist to quarterback your compensation package brings in tax, financial planning, and wealth management skill sets to meet the exponential leap in pay complexity you’ll face in your prime earning years.

[1] Concentrated Stock Portfolios. Cambridge Associates, LLC.

Disclosure: The opinions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. SYM reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs and there is no guarantee that their assessment of investments will be accurate. SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees and objectives can be found in our ADV Part 2, which is available upon request.