Are inflation concerns getting to you? It can be unsettling to watch gas prices and the cost of weekly groceries go up, up, and up. Inflation can erode wage increases to the point that paying for anything from braces to electricity can become a stretch.

Why is this happening and who is responsible?

Some pundits and pontificators point the finger at the U.S. Federal Reserve.

“The Fed” has a mandate for monetary policy commonly known as a “dual mandate”: to keep consumer prices stable, and to promote maximum employment. That can be a tough balancing act, and the Fed has several tools to accomplish its goals. One of those tools is the Federal Funds Interest Rate. Explained simply, the Fed can adjust the interest rate up or down to expand or contract the money supply. Those actions can influence employment rates, prices, and economic growth.

Today, with the U.S. Consumer Price Index (CPI) climbing 7.5%, pressure mounts on the Fed to step up and fight inflation.

And, naturally, lots of people have an opinion about the best way to do it.

“Fed Watching” has become a national sport on financial television. Show guests sound off about the Fed (namely the Fed’s Chair, Jerome Powell) being behind the curve when it comes to combatting inflation. Powell has been criticized for anticipating inflation would be tamed more quickly than what we have seen so far. Critics think the Fed should have intervened sooner.

In Defense of the Fed

From our view, the Fed has a strong record of keeping inflation in check over the past 40 years. Many of the sensationalized soundbites implicitly admit this by pointing out that this is the highest inflation in nearly four decades. It is important to remember just how low the pace of consumer price increases has been over the years.

Dramatic warnings and hand-wringing from alarmist strategists do nothing to help investors; moreover, they miss a critical point. COVID and its dominoes were unprecedented. Even as the country is learning to live with the ever-evolving virus, things are far from normal. Strong consumer demand, ongoing supply chain bottlenecks, and the emergence of the Omicron variant have all contributed to recent rising prices. The Fed has its role to play, to be sure. However, some of the inflation that we are seeing today is driven by things outside of the Fed’s control.

What About Those Interest Rates?

At the end of the day, all the Fed’s roads lead to economic growth.

A part of the Fed’s dual mandate is keeping employment high, which connects to economic growth. A look at the real Gross Domestic Product (GDP) will tell you that it looks just fine right now. In fact, the fourth-quarter GDP growth rate was good enough to power the U.S. economy to its strongest expansion (after inflation) since 1984. You read that right, we are experiencing a multi-decade high in economic growth.

In addition to the dual mandate, the Fed is also tasked with keeping long-term interest rates stable. That, too, connects to economic growth. Stability in borrowing rates gives the economy confidence to grow at a steady pace. That explains why even a hint of a surge in short- and intermediate-term Treasury rates can trigger some long-time Fed critics to come unhinged. Whether the Fed does something or holds back, the noise in the media is inevitable.

Today, the Federal Funds Rate is as low as it has ever been, with the target range of 0.00–0.25%. The Fed has ample dry powder to raise it back to historical norms if initial efforts to cool inflation don’t yield satisfactory results. Keep in mind that if Omicron continues to fade, more folks go back to work, and as supply chain issues ease up, inflation may subside without much intervention.

If that outlook does not become reality, the Fed can tap the brakes on inflation with higher Effective Fed Funds Rates. Powell has already pointed out that the economy is strong, that inflation is above target, and that interest rates are on the increase.

Stock Market Remains a Hedge Against Inflation (and Rising Interest Rates)

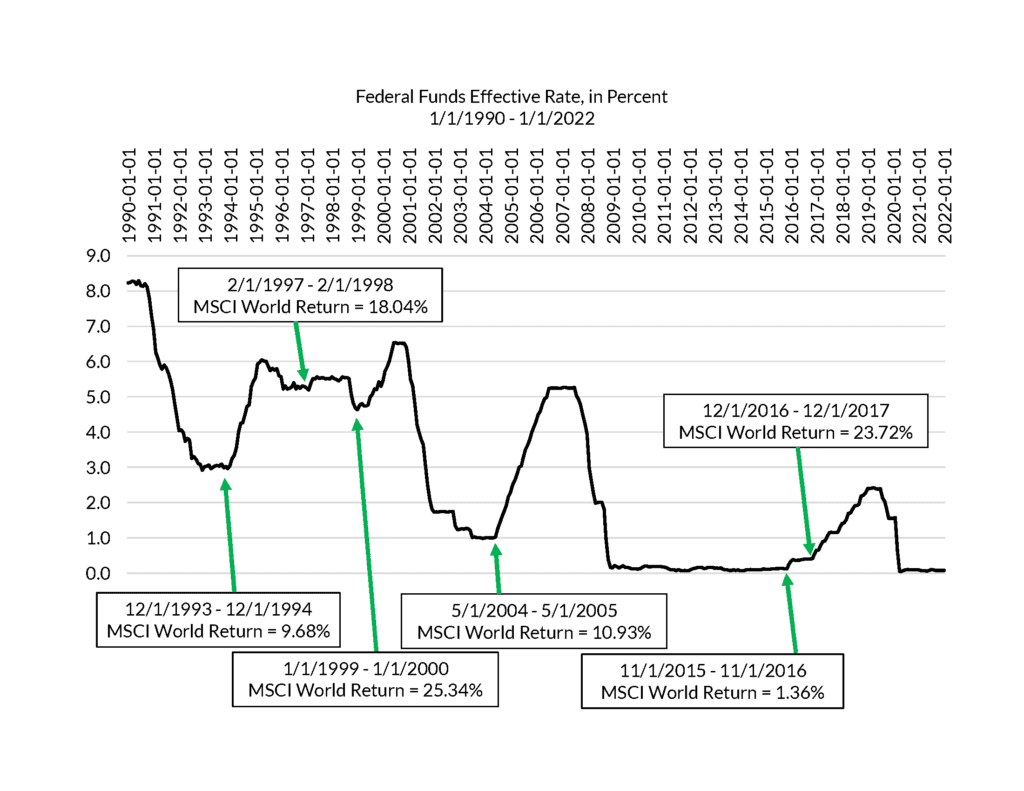

Meanwhile, the stock market has taken everything in stride despite some volatility in January. Good news for investors: we believe the stock market continues to be a good hedge against inflation and rising interest rates. The proof is in the historical data. Previous instances of Fed rate hike cycles have been good times to own a diversified basket of global stocks.

Stock Market Performances During Policy Rate Increase Cycles (1990–2022) (Sources: St. Louis Federal Reserve and Morningstar Inc.)

So, beyond managing your lifestyle for inflation and increasing your pay, one of the best ways to potentially hedge against rising prices is to stay invested in the stock market.

Monday Morning “Fed Watching” and Our Take on Inflation

We expect that the Fed’s battle with inflation will be a talking point in mid-term election campaigns — and a source of short-term market volatility. However, we believe this is a non-event for the way our clients are invested.

The SYM Financial team looks at investment time horizons of 7–10 years, which is typically enough time to weather volatility from any source (be it inflation, rising short-term interest rates, or something else). We are big on evidence, and history shows that even short-term investment holding periods following the Fed’s initiation of previous rate hikes have been positive.

Every market is different, and no forecasting tool is perfect. We encourage anyone who is implying that there is a direct link between Fed rate hikes and stock market devastation to look closer at the data.

Our bottom line is that we believe sticking with your investment plan is the best way to navigate inflationary pressures and rising interest rates. A diversified portfolio that reflects your goals and risk tolerance can be a powerful tool for staying invested, taking advantage of the markets, and keeping an eye on the ball. If you would like another look at your investment choices or retirement goals, reach out to a member of the SYM Financial team and schedule a quick call today.

Disclosure: Past performance is not indicative of future results. The opinions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. SYM reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This material contains projections, forecasts, estimates, beliefs and similar information (“forward looking information”). Forward looking information is subject to inherent uncertainties and qualifications and is based on numerous assumptions, in each case whether or not identified herein. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness. SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.